Louisiana’s Buried Bucks: Where Did All the Money Go?

Last year, fiscal year 2022, the legislature had at its discretion nearly $1.7 billion in additional revenue to spend at the end of the year. $1.2 billion came from the amount of money taxpayers sent to the state that was over and above what was originally estimated to be collected at the beginning of the year. $473 million came from various transfers and “savings” from within state government that some call budget shenanigans. These so-called savings come from things like increased gambling or lottery revenues that flow into funds for education, so when those revenues go up, they replace the state’s general funds that were originally placed in the budget for education expenses. Another scenario is when the federal government, like it’s been doing since the beginning of the pandemic, decreases the amount of state funds needed to match federal funds for healthcare expenses. That, too, is deemed a savings. These techniques are called fund transfers and they’re used to backfill the state’s general fund, freeing it up to use for other purposes.

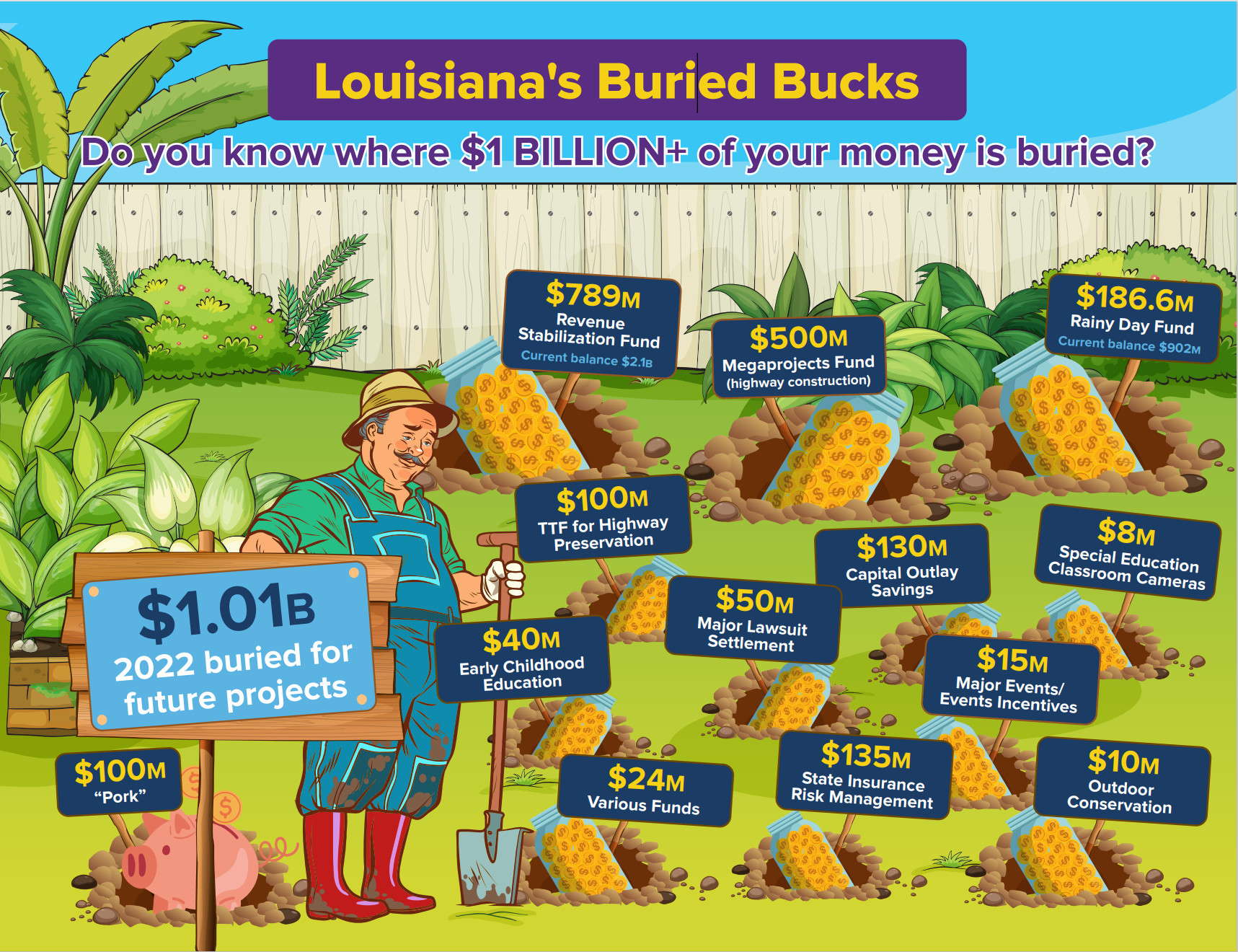

In addition to the $1.7 billion in excess money, the state also raked in other funds that can only be spent the way the state constitution dictates. In FY 2022, the state collected near record amounts of revenue from the corporate income and franchise taxes. The constitution dictates that anything collected over $600 million from these two taxes must go into the Revenue Stabilization Fund. That amounted to an additional $789 million, bringing the balance of that fund to $2.1 billion.

The state also had extra revenue left over from the prior fiscal year, approximately $727 million. Twenty-five percent of these funds must go into the Budget Stabilization Fund, colloquially known as the Rainy Day Fund. That amounted to $182 million, bringing that fund balance to $902 million.

This brings the total amount of savings in the two stabilization funds to nearly $3 billion – a large sum of money Louisiana can and should use for future tax reform.

So how did the $1.7 billion in excess money from FY 2022 get spent?

Over $1 billion was transferred to various funds for different projects and savings accounts.

- $605 million for transportation “megaprojects” and other highway construction and maintenance.

- $135 million to shore up the state’s risk management program, which is a self-insurance plan for the state’s properties.

- $130 million for the capital outlay savings plan to be used on future construction projects for the state or local governments.

- $50 million for the final payment on a decade’s old lawsuit settlement.

- $40 million for an early childhood savings account, which will be used when the federal government stops paying for this new program next year.

- $15 million to various events incentives funds to help the state and local convention and visitors’ bureaus attract sporting events and music festivals.

- $10 million for the Outdoor Conservation Fund.

- The remaining $32 million was deposited into various funds for programs like housing roof repair, local water systems, student teacher scholarships, cameras in special education classrooms, and to repair the state’s emergency communications system.

The remaining $622 million was actually spent, and not just saved for expenditure on another day:

- $227 million to reimburse the federal government for disaster-related expenses.

- $154 million added to the operating budgets of various departments.

- $128 million allocated for highways.

- $126 million to pork projects and to local governments for various projects.

- $20 million provided for local water and sewer system projects.

- $6.7 million for lawsuits.

Just in the last two years (FY 2022 and 2023), the state has had excess revenue of $4.4 billion, over and above what is needed for normal operating expenses. Before the train derails, now is the time to bring spending under control and give the citizens of Louisiana REAL tax relief. Now is the time to write Louisiana’s Comeback story to spark economic growth that will allow every Louisianan to flourish.