Responsible Budgeting and Spending Comparisons in Louisiana

The Pelican Institute has highlighted the need for better state budgeting and tax reform. This includes the Responsible Louisiana Budget (RLB), which was released earlier this year. The RLB shows that Louisiana’s budget has been growing at unsustainable levels, and that an improved growth factor for the expenditure limit and initial appropriations is needed.

Recently, Americans for Tax Reform released a similar comparison for all 50 states, including Louisiana, in its Sustainable Budget Project. This report shows that, on the surface, Louisiana’s spending has not been as unsustainable as the RLB shows.

Why is there a different outcome in the two reports?

- The RLB is using initial appropriations, otherwise known as the state’s operating budget at the beginning of the fiscal year; whereas ATR is using actual spending, which is a backward-looking measure. The differences between amounts budgeted and what is actually spent can vary greatly.

- The RLB is based only on state funds—state general fund, fees and self-generated revenues, and statutory dedications; whereas ATR’s study uses total funds, including federal dollars.

Outcomes of Each Report

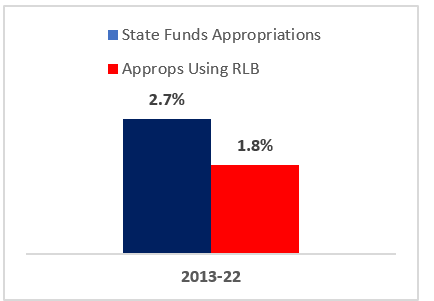

The Responsible Budget model is currently being used successfully in other states to rein in spending. This is what Louisiana’s budget would have looked like had the RLB been employed over the last ten years.

- State funds appropriations were 0.9% higher than it would have been if the state had used the RLB over the last decade.

- State funds appropriations were $18.7 billion in 2022, which is 11.8%, or $2 billion, higher than what a Responsible Budget would have been.

- This means that the average household is paying about $2,700 more in taxes this year.

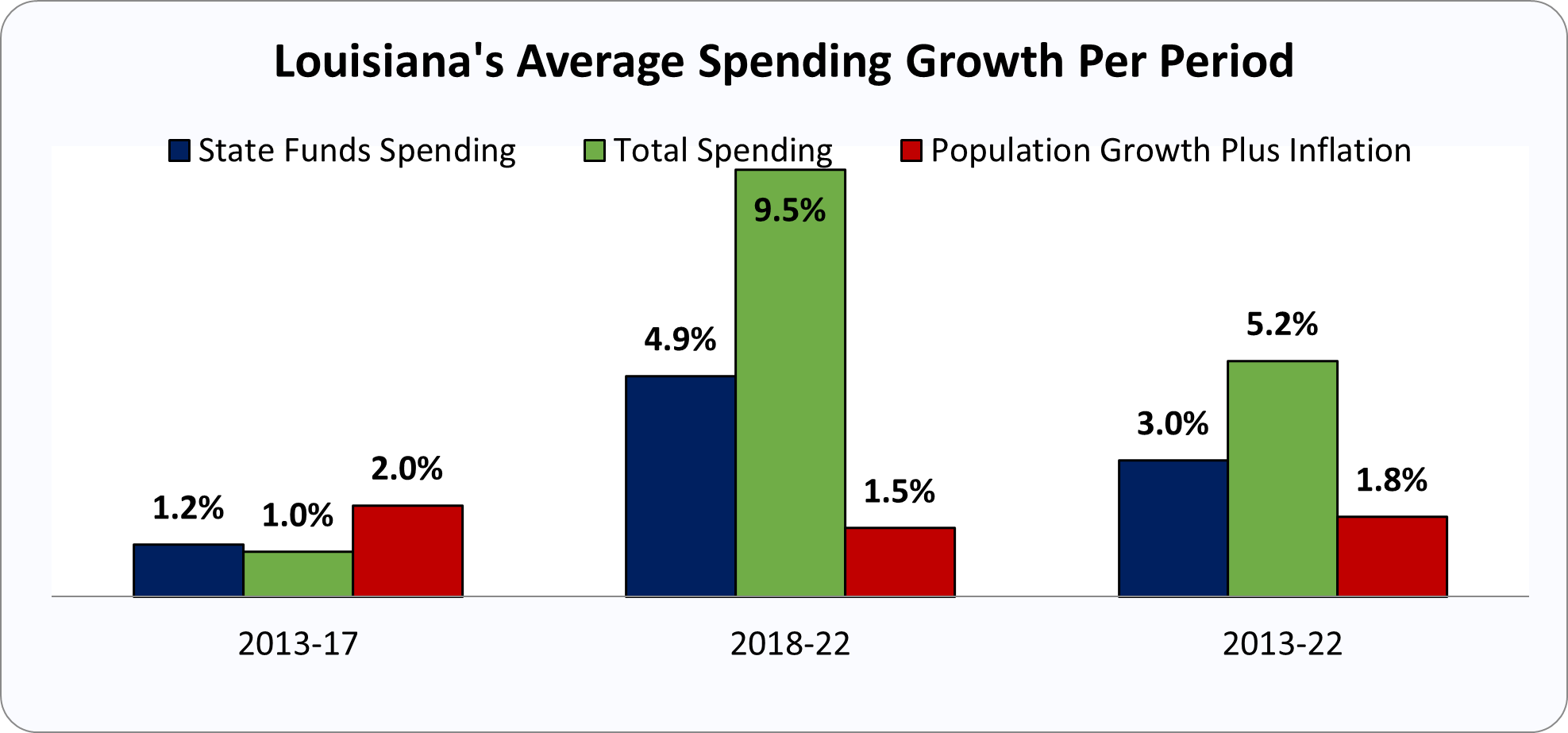

Here are the findings from ATR’s Sustainable Budget study over the last decade:

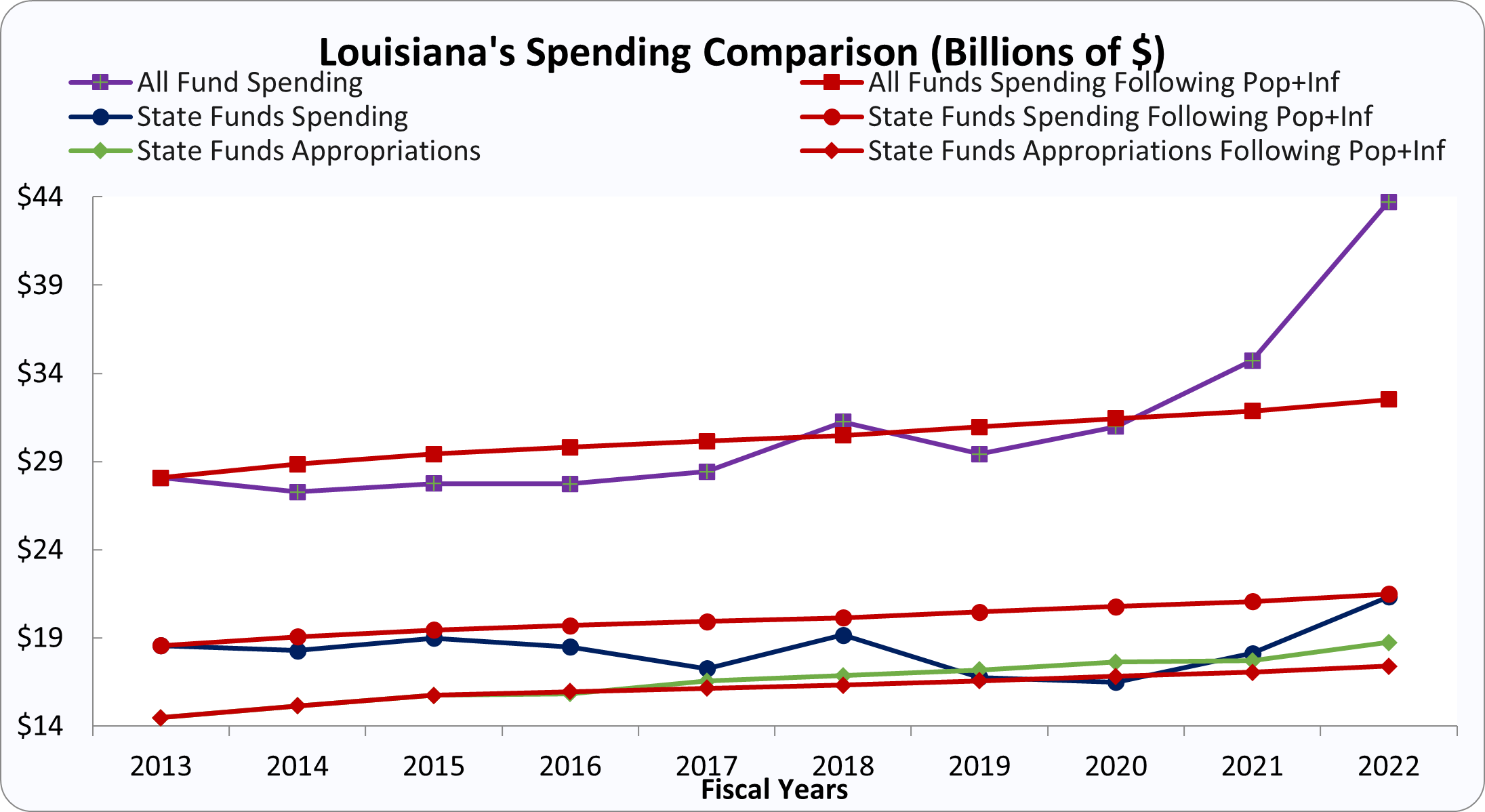

- Over the last ten years, spending of state funds and total funds has exceeded the population plus inflation growth factor. State funds spending was lower in the first five years of the decade, increasing by an average of 1.2% per year while population growth plus inflation increased by 2.0% per year. However, state funds spending greatly increased in the last half of the decade by an average of 4.9% per year, where the growth factor was only 1.5%.

- Total spending in FY 22 was 34.4%, or $11.2 billion, higher than the improved expenditure limit. This means that a family of four is paying $8,800 more in taxes to pay for the excess spending, which is not sustainable spending.

Is One Report Better Than the Other?

Is One Report Better Than the Other?No. Both reports are accurate and serve different purposes.

The RLB uses initial appropriations which helps lawmakers easily compare appropriation amounts from year to year as they are drafting the budget during session.

Because it covers spending instead of appropriations, the ATR study is a backwards-looking metric that can be used for making longer-term spending decisions, but it will be limited in its use during a legislative session.

Both reports compare the current expenditure limit with a proposed improved expenditure limit. The current limit is the three-year average of personal income growth, which is an extremely volatile measure. The proposed improved limit is the three-year average of population growth plus inflation. The RLB and ATR reports can work together, providing limits on the front and back end to ensure that spending remains responsible throughout the year.

Both reports show recent elevated appropriations and spending. There is clearly room for budgeting restraint in Louisiana. These measures have benefits to lawmakers and the public so that they can have the tools necessary to restrain government spending and provide a responsible budget. Doing so will have many payoffs over time, including making the comeback in the Pelican State happen more quickly by eliminating personal income taxes, providing a more dynamic economy, and improving opportunities for people to flourish.